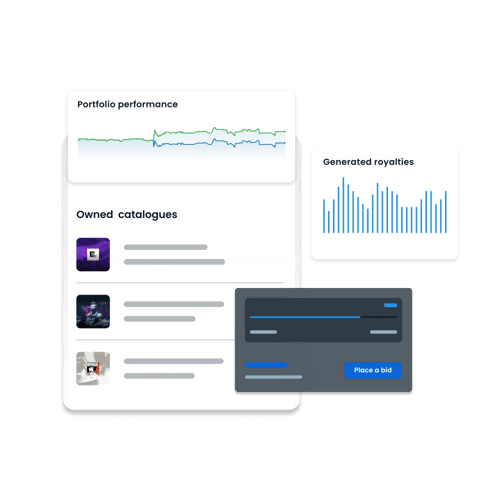

Your music investment journey

Create an account for free and discover music royalties as an alternative asset class. Buy, sell or trade shares in music catalogues and sit back listening to music while you generate a passive income stream.

GET A FULL OVERVIEW AND DOWNLOAD OUR FREE BOOKLET.

How does it work?

The entire process from listings to receiving payouts in just five simple steps.

01 Listings

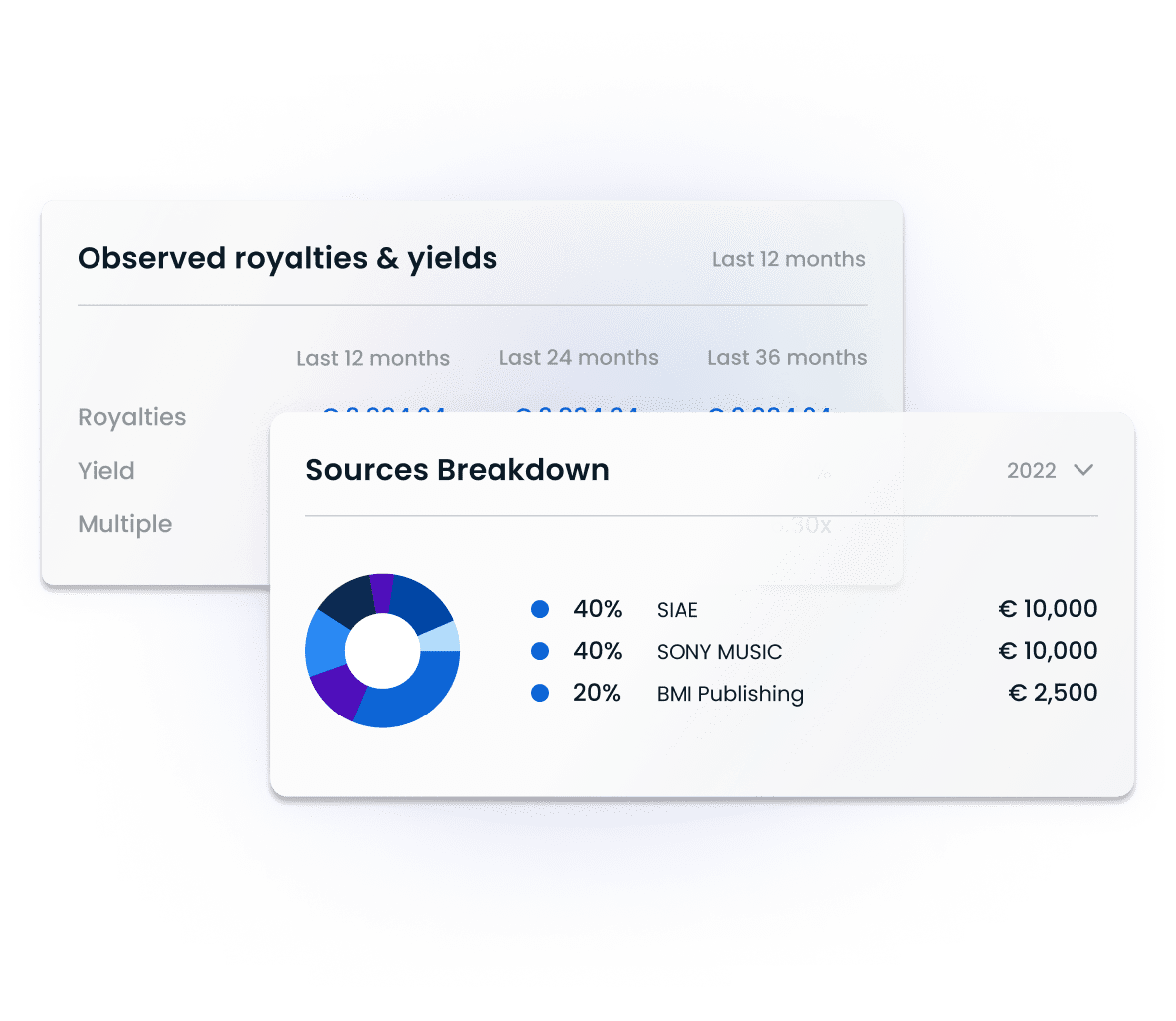

02 Financials

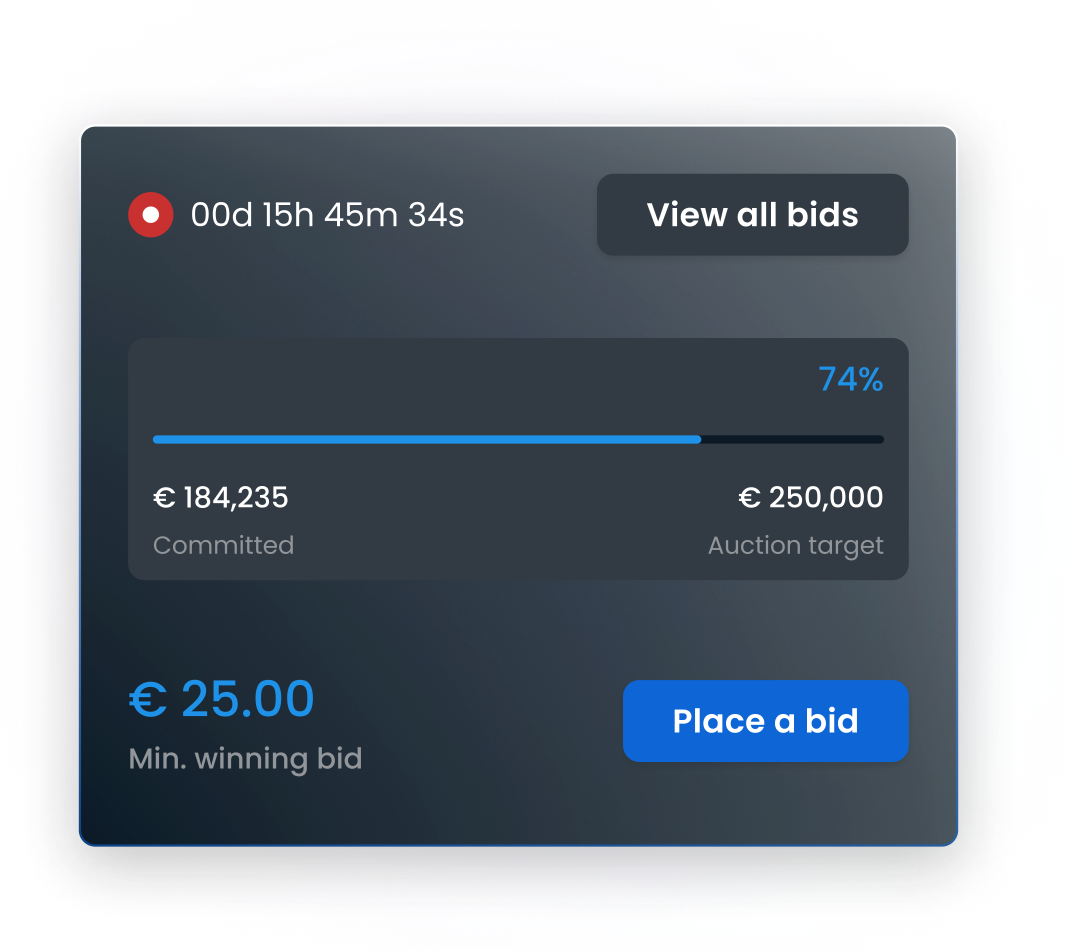

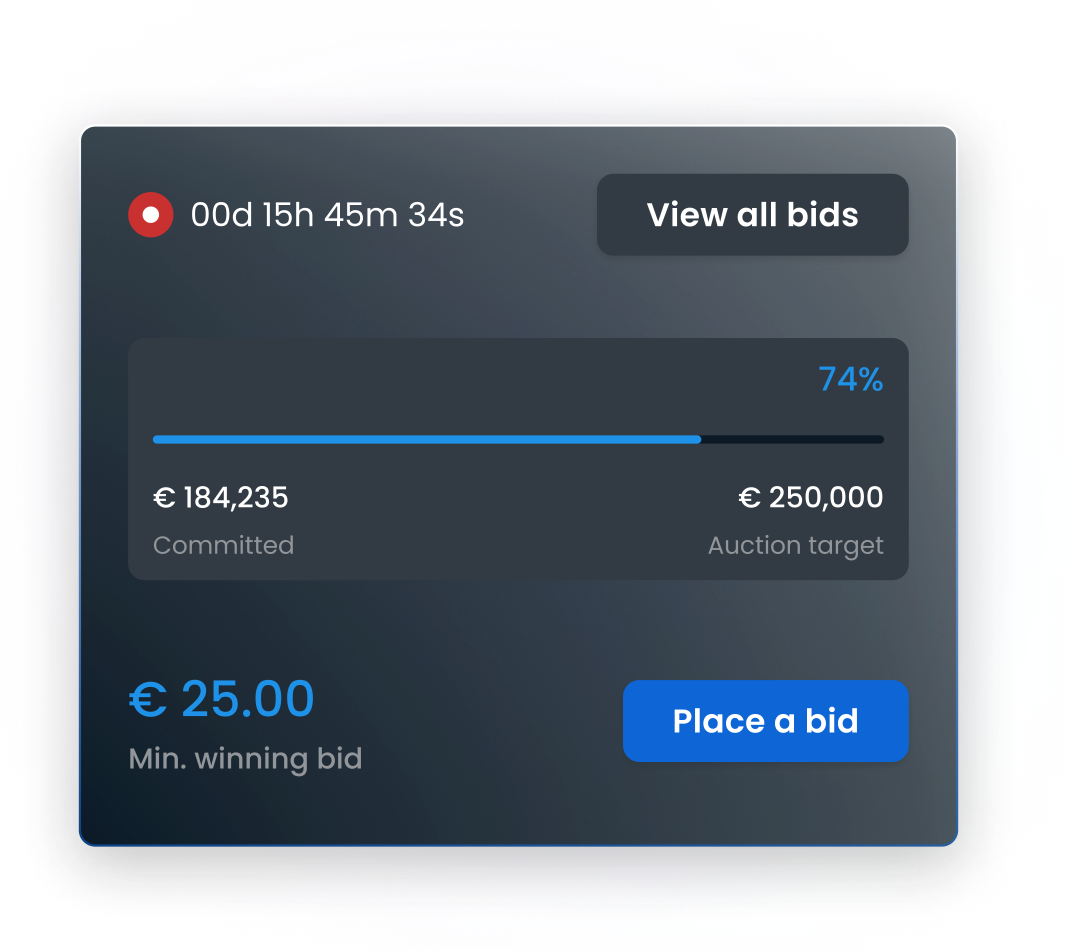

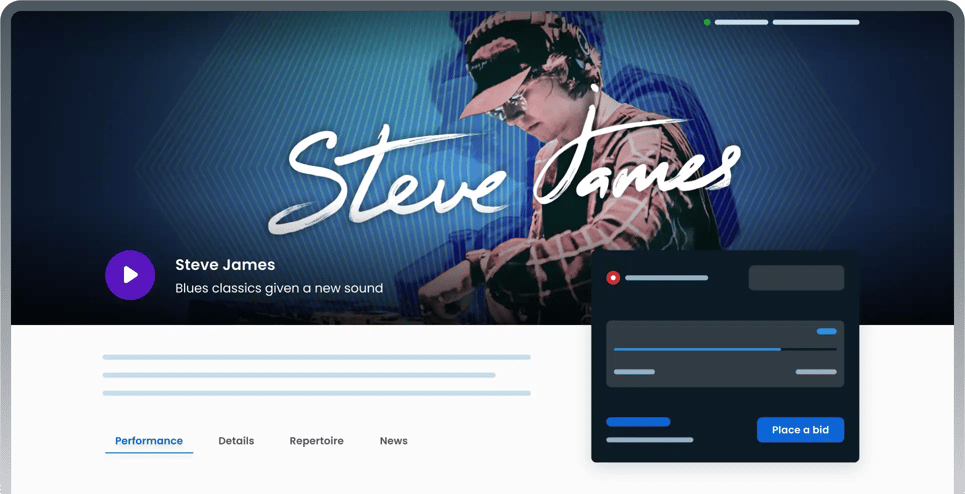

03 Bidding

04 Trading

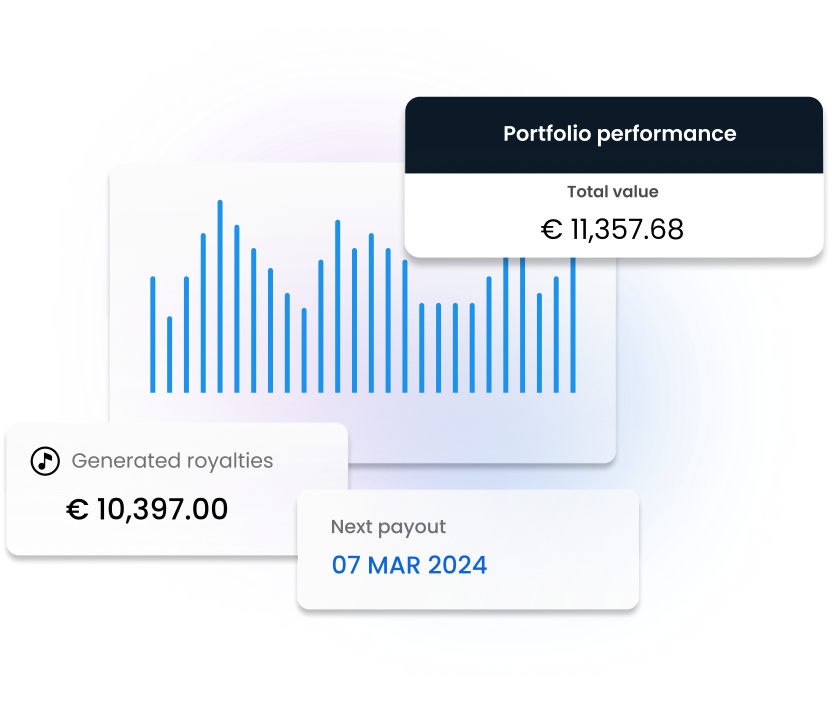

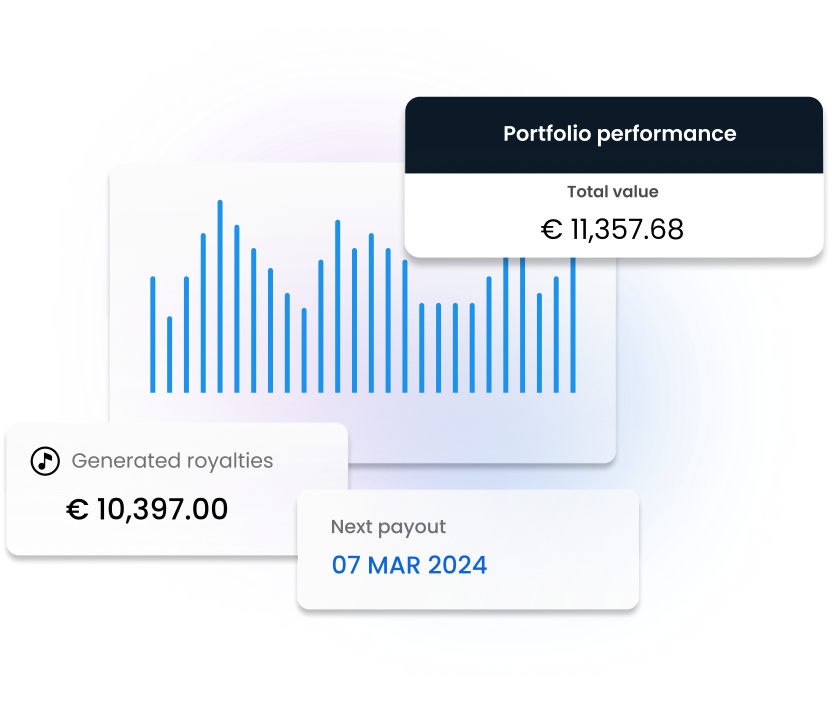

05 Royalty Payouts

01 Listings

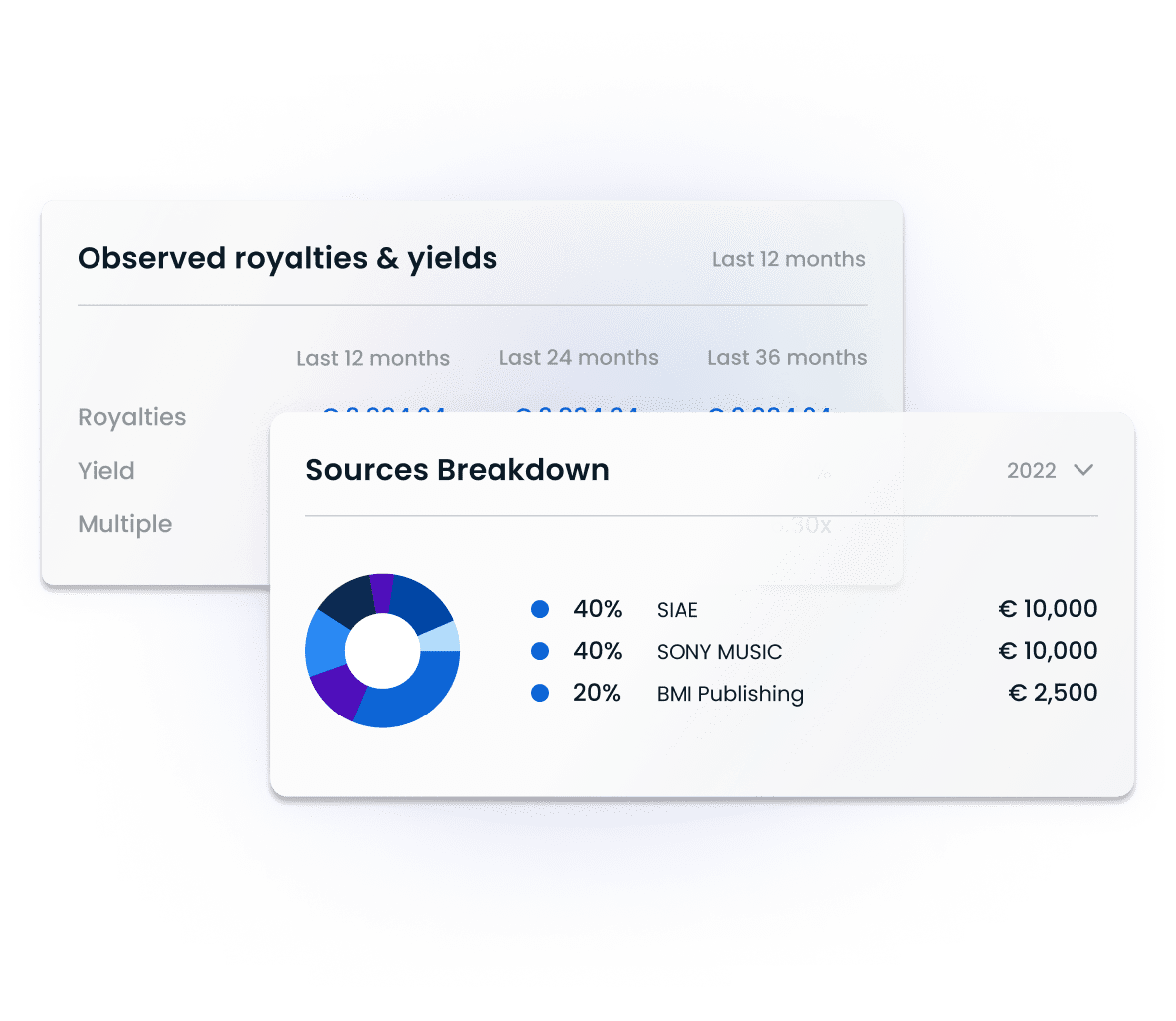

02 Financials

03 Bidding

04 Trading

05 Royalty Payouts

Why would music creators list their catalogues?

Engagement

Music creators are always looking to establish a deeper connection with their fanbase and network. Listing their catalogues provides great exposure.

Boosting projects

Rights owners can leverage on their music catalogues to get direct and immediate access to funds, otherwise earned over a series of years..

Creative control

Artistic freedom and management remain 100% in control of the original rights holders, maintaining the power in the hands of the music creators.

ANote Music

The Integrated Solution

We embrace innovation and empowerment, not disruption. No job loss for the music industry, no players threatened. Our platform provides mutual advantage for the financial market and music creators.

Catalogue performance - Example

Music catalogues are usually valued at a multiple of past net royalty flows. Assuming no future growth or decrease in the royalty flows, theoretical rates of return can be easily calculated, especially for those contracts with a particular maturity.